Contact Us

Have a question, suggestion, or want to get in touch? Shoot us a message and our team will respond as soon as possible.

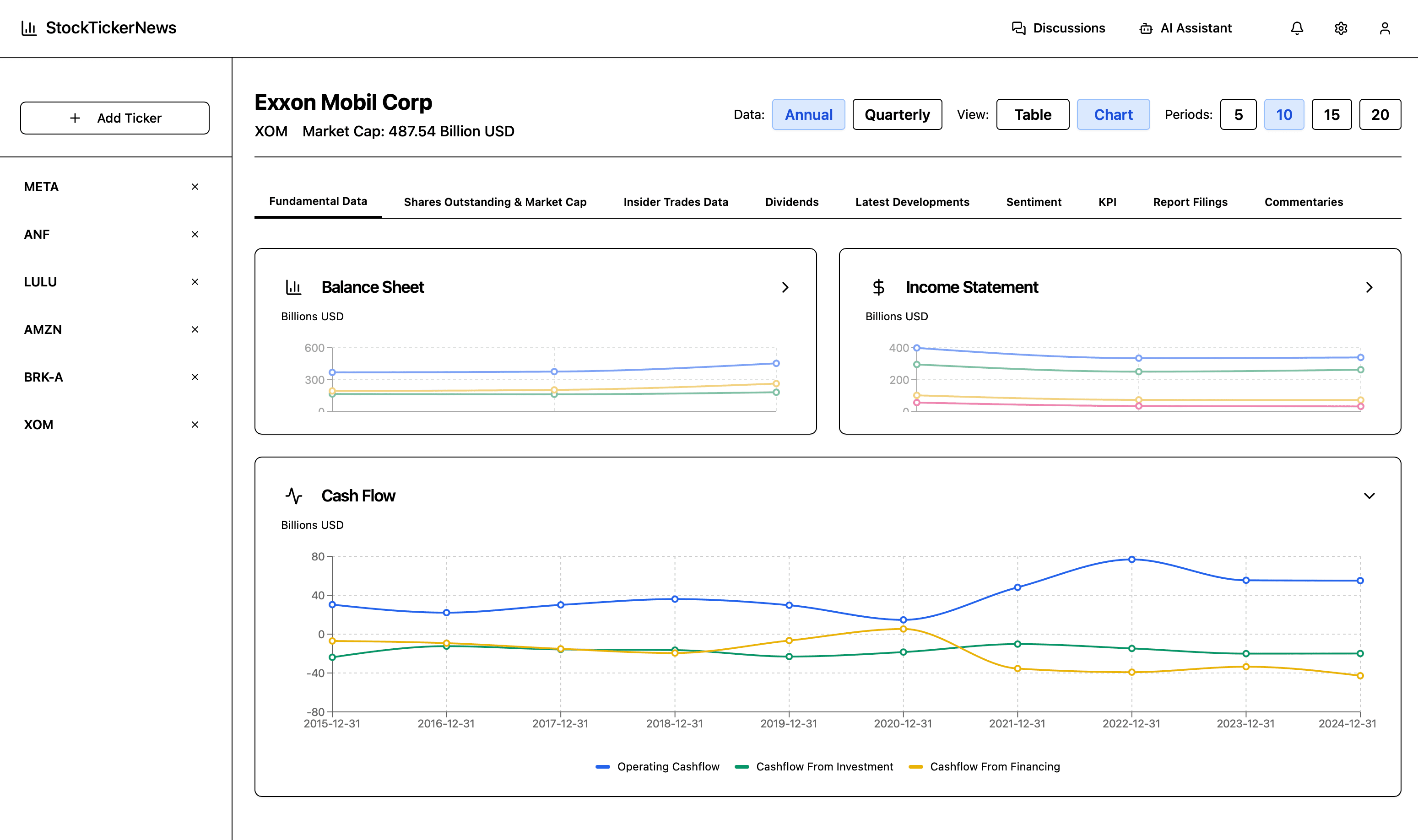

The essential yet affordable suite of fundamental data for NYSE and NASDAQ

listed stocks.

Try the fundamental data platform.

Our report combines the most important financial metrics into valuable insights that help you make informed investment decisions.

Full quarterly and annual financial reporting data updated with most recent official submissions to SEC. Dive into detailed income statements, balance sheets, cash flow statements, dividend distributions, historical market capitalizations, and more.

Monitor the latest executive transactions to track insiders' conviction of the business.

Engage in ticker specific discussions with others and collectively assess the strategic and financial performance of the company or even participate in shareholder activism.

Stay informed about acquisitions, partnerships, product launches, and strategic initiatives that impact underlying business thesis.

Scoring of news articles with sentiment to gauge bullish or bearish market perception.

Your personal AI Assistant with access to context data at your fingertips.

Ideal for individual analysts and sophisticated retail investors

billed monthly

Best for wealth managers and investment advisors

billed monthly

Customized solutions for family offices, Hedge Funds, Asset Managers starting at

billed monthly

Monthly subscriptions can be canceled anytime.

Have a question, suggestion, or want to get in touch? Shoot us a message and our team will respond as soon as possible.